[Female voice]

Access to financial services is vital to global development because having an account makes it easier to invest in health and education or in a business. Accounts also help families manage economic emergencies that can push them into poverty. As of 2021, 71% of adults in developing countries have an account with a financial institution or mobile money provider. This is an increase of more than 50% from a decade ago. Digital financial services and particularly mobile money drive inclusion. In Sub-Saharan Africa, 33% of adults use a mobile money account. Access to financial services can help empower women, and technology has helped narrow the gender gap in financial inclusion.

Although in developing countries, men are still six percentage points more likely than women to have an account. COVID-19 accelerated adoption of digital payments. One third of the adults in developing countries who paid utility bills directly from an account did so for the first time after the start of COVID-19. In Latin America for example, 40% of adults use their account to pay a merchant in store or online, including 14% of adults who made their first merchant payment from an account during the COVID-19 pandemic. There remain 1.4 billion unbanked adults worldwide. Digitalization may be our most powerful tool for building on the momentum of the past decade, helping build financial resilience for the millions who need it most.

[Rachelle Akuffo]

Welcome to our virtual audience tuning in from around the world. I'm pleased to welcome you to the launch of the Global Findex Report. I'm Rachelle Akuffo here in Washington DC at the World Bank Group headquarters. Now, this event is being broadcast in English, French, Spanish, and Arabic, and of course you can follow along online on Facebook, Twitter, and Instagram. Now, please use the hashtag Global Findex. We'll also have a bank of experts standing by to answer your questions at live.worldbank.org.

As you heard previously, Global Findex measures people's access to financial services, which means having safe, private, and easy ways to store money, to save, access credit, and make payments. More financial inclusion not only plugs people into the global economy, it also enables them to be more resilient to crises. Now, this is critical for global development and has been particularly important during the many crises of the last few years.

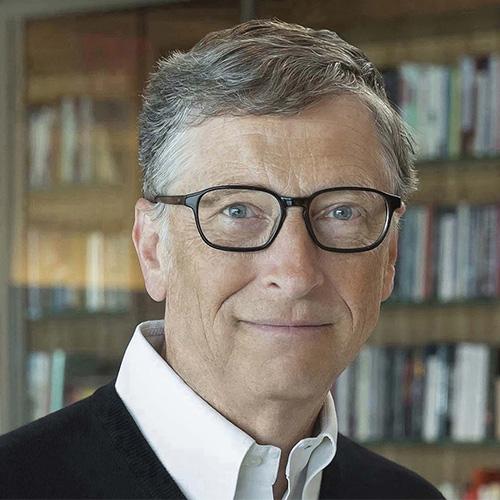

First we'll hear from World Bank Group President David Malpass, and Bill Gates, Co-chair of the Bill & Melinda Gates Foundation about what they're excited about from this year's report. Then, we'll take an in-depth dive into the data and findings from this year's report, and finally, a global panel of distinguished experts will discuss how we got here and why. Let's get started.

I'm joined here today by the President of the World Bank Group David Malpass, and Bill Gates, Co-chair of the Bill & Melinda Gates Foundation. A real pleasure to be speaking to both of you today.

First, Mr. Malpass, according to the latest Findex Report, there has been notable progress in improving both access and usage of financial services. Why is this so important for development?

[David Malpass]

Hello, Rachelle, and very good to be with Bill. It's really important because as people have some access and as they have some usage, they get more information, it helps with all sorts of their activities. Farmers can farm better, women can provide better within their family, governments can give cash payments to people if that's necessary and each part builds on itself. I was happy to see in this latest Findex Report an increase in the account availability, so we're now at 76% in developed countries and 71% in developing countries. That means more people are having accounts and they're able to use them as the opportunity arises.

[Rachelle Akuffo]

These are really some incredible trends that we've seen emerging and liked what we've all seen in the past few years. Mr. Gates, in terms of the trends, what do you see as the most important for financial inclusion? Can you give us an example of countries that are either making or leading progress?

[Bill Gates]

Well, India's a great example of a country that's gone from having a gigantic gap between men and women's access to accounts. Now, they're up to 78% of both men and women. If you go back to 2011, it was only 26% of women had access to accounts. India's also a great example of one of the things David mentioned, which is connecting their government payment programs that often involves high fees or money misdirected or long trips. Now, that that's going straight to their phones in the form of mobile money, you're cutting out the middleman, you're making it very straightforward, and for many programs, including some that were key during the pandemic, they took advantage of that. Kenya was one of the early countries, did very good things. I'd say we have a dozen or so countries, including India that are showing the way.

[David Malpass]

The report showed that 34 countries had gains of more than 10%. One of the things the report is picking up is the widespread advances that are going on. Part of that is technology. Bill, I wonder, what do you think is enabling that? Is it getting cheaper to have this kind of technology or it's just catching on, or what do you think are the big factors?

[Bill Gates]

Well, the pervasive use of cell phones is what we're building on, and we never were going to get there in terms of low cost fees and convenience when it had to be physical bank branches. Now that it's digital and the user interface is being made so that it's very straightforward to work with, not only is there access to savings, but you can move money between family members very easily. Over time, we expect you to have the software on the phone, giving you advice about how to manage your money, and the fee structure is really quite incredible. In India, consumers are moving money to each other without any cost whatsoever, and we're also using this to make sure as remittances come into a country that the fees on the receiving side, and those are large numbers, which the World Bank has documented how important those are in many countries.

With open source software to help the central bank and the government's finance department figure out how to do the identity and do the low cost switch, the barriers to entry for this are getting lower, and it's out there as open source and the countries want to help. Every new implementation benefits from what's gone before.

[Rachelle Akuffo]

Those lower barriers to entry, very important as we see more people sort of having mobile payments as a gateway essentially.

[David Malpass]

I think it's a big and important shift. The metrics used to be aimed at how many people had bank accounts. That proved to be actually not the lowest cost way of providing financial services, and so people would drop out. And so, what we're now trying to achieve is as many transactions as possible and having the cost per transaction go down. In an ideal world, especially a world that has many millions and hundreds of millions of poor people in it, you want to be able to have billions of transactions, but have the cost be a tiny fraction of a cent. World Bank is working on 57 projects in 44 countries. We're trying to have this broad effort to really boost up the availability of mobile of cell phone kind of networks.

People are now saving in cell phones. It used to be you'd save in a bank account. Well, that was very hard in poor countries because you didn't have time to be in the line. They didn't have time to pay a teller to take your engagement at the bank. Now if you can do it on the cell phone, it can be cheap, which is really important. I wonder Bill's thoughts on what the biggest obstacle to having that be even broader. Are we moving to a world where there'll be satellite cell phones or a world that has fiber optics in rural areas, or what's the technology step that's needed next?

[Bill Gates]

The cell phones do keep getting cheaper, even the ones that have internet connections, and so there's so many applications, even beyond the financial services there. The hard part in getting these mobile money going in the country first is to get the regulations right so that you have interoperability and low fees. Then you have to get out there with lots and lots of places where people can convert physical cash into digital money and vice versa.

Only when they see a pervasive number of cash in, cash out points, then they begin to think of the digital really as every bit the same as the currency, and then eventually, you start to have retail shops accepting it directly, and over time, actually, the digital approach should out compete currency because it's easier for the retailers. It's easier for tax collection for the country, even things like avoiding corruption where you see the flows of money, currency isn't as good. I think we're in a journey here where cheap cell phones, open source software, getting the regulations right, and getting the critical mass in country after country... I'd love to do this event someday and have the Findex number reach 90 or 95%.

[Rachelle Akuffo]

And, building what you said earlier, Mr. Malpass, we did see that the Findex Report shows that people in developing countries started using mobile money accounts to build savings through high volume, but small value transactions. What do you see as the role of digital finance in building financial resilience?

[David Malpass]

If people have that as a backstop, meaning if something happens that's gone wrong in the country, maybe there's shortages, as we're seeing now in a lot of the food chain, they have some backstop. That means that they can go to another village and buy things that they can survive for a few weeks if the crop... One of the problems that we're facing right now is people's harvests aren't as good because there's not enough fertilizer, the shortages are spreading. Having information is really important, and then having some kind of savings backstop is important. One other thing that's that shows up in this Findex Report is the gender gap has narrowed some, which is good. There still is a gender gap. The data is showing like 78% of men have accounts, 74% of women have accounts, so there's a gap, but much less than there was.

That's so powerful because women are frankly better at taking care of the family in the event of a crisis. She knows what food is needed today or tomorrow or next week, and so that's really important to have women fully engaged in this financial system of having accounts. One of the interesting things I learned about this is in the US and in Europe, there tends to be joint accounts, a man and a woman have an account, but in most of the rest of the world, that's not the case. They have individual accounts, and in many places it was just a man that had the account. If you now start having more women with accounts, they can save money and take good care of themselves and the family. That's a big plus.

[Rachelle Akuffo]

That's essential, there's nothing more destabilizing than essentially having a crisis within a crisis, when you already have the pandemic and the sort of domino effects, as well. Mr. Gates, I do want to ask you, in terms of how countries can build on the progress that we saw in this year's Findex Report, what innovations and opportunities do you really see in accelerating the access and usage of digital finance?

[David Malpass]

Good question.

[Bill Gates]

Every citizen ideally would have an identity and India has done a very good job, both in making that pervasive and thinking through the privacy issues so that so-called ad-hoc identity is used across a variety of government systems. Financial inclusion is often the thing that bootstraps that system, but then it can be used for all sorts of government payment schemes, or even to connect you up in health and education, as well. The digital revolution is one of the things that really can improve governance, make government more accessible, make advice more accessible and actually get markets to work. Our advice to countries is that they ought to pick, it's the minister of finance or the central bank in some mix where they look at the model regulations that we've learned a lot about making sure that privacy and cyber security aren't forgotten in these things, that they move forward with the identity system but not just for financial payments.

Then, they work with donors and other partners to say, "Okay, how do we drive this to critical mass? How do we get the big employers to do their payroll connected up to this, the government payment systems connected up to this?" Also, over time make it so you can move money even across borders because that's important. The World Bank, Gates Foundation, the entities involved in this, stand by as governments are seeing this opportunity. They're seeing what the leaders are getting out of these systems and that it's large-scale stuff. It's starting to be that in some countries more goes through the digital system than actually goes through currency type payments. It's a great opportunity for countries. We still have a lot of people not included but we have a roadmap that is feasible without billions of dollars of extra money to build these really empowering systems.

[David Malpass]

I think that's exactly right. There's a transformation in development because you can track people and provide assistance if that's what's needed but also they get access to the system much better. I think an underestimated part of the development challenge is to get people with a unique identifier and then registered within the system. There are obstacles to that. It's difficult for countries to do that. They need to do that in a fair way. You can't just register your own political party, you need to do both sides of the aisle. You can't just register men, you have to do women and girls have to have birth certificates just like boys do. Once that is established, it's really empowering, and I think we need to build on that more. If we think about it in our own lives, we've gone from where you used to have a telephone number for your residents. Then, if you moved, you had to redo it all. Now you have a cell phone that stays with you almost for life, which is scary on the one hand, it raises privacy issues, but people come have come to accept it and realize what a giant benefit that is.

I think that's spreading much more rapidly in developing countries, the idea that a person has a number, and once you have a number you get access to services, you get an ability to find your family when there's a displacement going on within the country. Even as Ukraine has been under war, as they moved, people were able to find each other and find a host family because they were a unique person, they existed, and that's what we're trying to create in more developing countries. It's by far not universal, and I think if we can get there, it's going to help with this financial inclusion as well.

[Rachelle Akuffo]

It really has become more than just a way to communicate. It really has become this pathway to financial inclusion. You did obviously mention the gender gap and account ownership narrowing for the first time. There do, of course, remain millions of women who are still unbanked. How is the World Bank Group really supporting access and usage of digital financial services for women?

[David Malpass]

For one, they have to know that they're available and then the training, some access point, often women to women teaching each other that it's available and how they can use the applications, and then I think also as more women are within the system, that creates its own market. There can be growth internally through better apps that are more tailored to what a woman wants to use. We have this combined problem. You first have to have access, and that means a legal regulation within the country that means that a woman needs to be allowed to have access, and then some funding or some first entry point for her, and then the applications that she wants to use. As I mentioned, the Findex Report is showing that there's a lot of progress being made on that to narrow the gender gap.

[Rachelle Akuffo]

Mr. Gates, I want to bring you in here. Obviously, we've all been through a lot. The last few years the pandemic has been a big wake up call. What lessons can be taken away from the pandemic when it comes to financial inclusion?

[Bill Gates]

Well, one of the few good pieces of news from the pandemic is that the digital systems were able to help us, help us do meetings, help us collaborate in the design of the vaccine, and help the digitized government payment systems were able to get out to lots of women in particular who needed that cash transfer. Obviously, it wasn't available in all countries and the affordability of cash transfer is a challenge but the exemplars saw that having these accounts let them have that immediate connection. Thank goodness we had made those investments.

It's really foundational. In the past if somebody wanted to save and the bank was too far away, or it was a small amount of money, they would have to put it into very inefficient things like buying an extra cow, which then might get sick, and so the illiquidity or overhead of previous approaches was really quite awful. The pandemic made us all realize we need to get going on digital, but payment systems in particular for government programs to help those most in need, at least in some countries, that was one of the bright points of what was otherwise a huge setback.

[David Malpass]

That's a great point. As people went from a barter economy, where you had to swap a cow for wheat, and then they began to have money, that was a huge enabling factor, and now we're moving to a next stage of having it be digital. It makes it even more powerful and that helps people trade, it helps innovation. That'll be a big step.

[Rachelle Akuffo]

Well, a very big thank you to Mr. Gates and Mr. Malpass for this wonderful discussion. We do appreciate it.

Now it's time to dive into the data and finds from the Global Findex. Let's hear from Leora Klapper, an economist of the World Bank, who has been the lead on the Global Findex project since its inception.

[Leora Klapper]

Financial inclusion matters. When an emergency strikes or unexpected expenses happen, too many people around the world are left without access to their money, or the ability to make an easy digital payment. Today, only about half of adults in developing countries can access extra money with little or no difficulty. Instead, they often turn to unreliable sources, potentially exposing them to fraud, theft, and other risks.

Having access to financial services doesn't just matter. During challenging times. Formal accounts at a bank or similar institution or in a mobile phone give people a safe place to store money, allowing them to save education and retirement or make and receive payments securely. For women especially, having a formal account provides them greater privacy, security, and control over their own money. Accounts enable financial independence and strengthen economic empowerment. Here's some good news, account ownership has increased over the past four years to now reach over three quarters of the world's adults. Today around the world, some 76% of adults have an account. That's up from 51% a decade ago. In developing countries today, 71% of people have an account up from just 42% a decade ago. Tremendous gains, gains are more evenly distributed and come from a greater number of countries than ever before.

The COVID-19 pandemic and response measures contributed to a surge in the use of digital payment methods in some countries. Today, two thirds of adults worldwide now make or receive a digital payment, and that matters because digital payments are safer and more convenient and are a gateway to using other financial services like savings. In China, where digital payments have exploded in popularity, around 80% of adults made a payment in the store using a card or mobile phone. Looking at other developing countries, some 40% of those who made a digital payment to a merchant did so for the very first time since the start of the pandemic. In some countries, the past five years have seen women's financial inclusion surge. The gender gap in account ownership has shrunk from seven to four percentage points globally. In developing countries, that gap has narrowed from nine to six percentage points.

Still, some 30% of adults in developing countries remain unbanked, and these people are hardest to reach, usually poorer, less educated, and living in rural areas. To reach them, governments in the private sector will need to work hand in hand to forge the policies and practices needed to build trust in financial service providers, confidence in using financial products, new tailored product designs, as well as a strong and enforceable consumer protection framework. Doing so will build in the momentum of the past decade to expand financial inclusion and with it the resilience that equips people to weather the natural ups and downs of their financial lives.

[Rachelle Akuffo]

Well, now we're headed for a panel discussion moderated by World Bank Group President, David Malpass.

[David Malpass]

Thank you very much, Rachelle. I want to say hello and good morning to everyone. We have a great panel. I want to thank our panelists who are with us virtually. We're going to have a discussion of these key topics. It's three developing countries and we want to emphasize the importance of innovation in order to increase the usage and the access to digital information. Let me name the panelists, and then I'm going to turn to each one. Ana Maria Prieto is the Director of Payment Systems at the Central Bank of Colombia. We have Coura Carine Sene, she is the Director for Wave Mobile Money operating in West Africa, and I had the great opportunity to meet with her when I was in Senegal earlier this year, and we finally have Sucharita Mukherjee. She is the Co-founder and CEO of Kaleidofin, a fintech platform that provides intuitive and tailored financial solutions to underserved customers. I read that, and I'm going to ask her about it, she has maybe 600 million users, so that's staggering, and it also points to the importance of innovation for development.

Let me go first to Ms. Prieto. The Findex Report, and we just heard the summaries, it highlights that promoting digital payments, wages, or transfers from government is a powerful way of increasing account ownership. Colombia deployed an unconditional cash transfer program during COVID-19. So, that means there were a lot of account users. Could you tell us about your experience with that? Why did it open new accounts and how did it work? Thanks very much for joining.

[Ana Maria Prieto]

Thank you, David. Good morning, good afternoon, good evening for everyone, and thank you for this invitation. I'm very honored to join this prestigious panel. As a response to the pandemic, the government of Colombia introduced Ingreso Solidario. This was a new non-conditional transfer program targeting 3 million low income households, of which 63% were women. It was initially set for three monthly payments of $42 around each, but it was extended now until December 2022. We launched the program in April 2020, following two key principles. One, focusing on beneficiaries' needs, and second, prioritizing digital financial inclusion to deliver not just the aid on time, but also give people a financial tool that could bring social change in our country. The program had a stage design to tackle the challenges posed by reaching these new beneficiaries. The first stage was for those already with an account, followed by the unbanked, for whom we set a comprehensive strategy for their onboarding through digital wallets offered by five financial institutions.

In the rural areas, and for those unreachable households, payments were delivered in cash with the help of financial agents, postal offices, and municipalities as well. Reaching those new beneficiaries was the hardest part, I have to say. Contact information was missing or outdated so we tried new ways. We partner with telco companies to send SMS, we deployed a strong social media campaign. This turned on alarms to keep fraud away as well. We have to advance as the way as we advance in contacting these new households. We supported financial entities in strengthening the risk mitigating policies as well. In summary, between April and June 2020, 2.6 million households were reached, around 1.4 million of them were already banked. They received the first aid only in seven days, but over the next two months, almost 1.2 million were financially included for the first time, 76% through digital wallets, 24% via face-to-face process.

During the emergency, we saw a switch from cash to digital, 45% of beneficiaries did at an additional cashing, and 62% of them used their wallet to pay utility bills and so on. A more recent study of the Better Than Cash Alliance on Ingreso Solidario shows up positive changes in financial behavior of these beneficiaries. When comparing those that receive the aid through mobile wallets, compare it to those that already had a bank account, the latter cashed out 10% less and 20% of the mobile wallet holders' practice savings. This is a positive trend and we need to keep consolidating in the future. The rapid design and implementation of the program was possible due to a longstanding commitment to enabling regulation, a flourishing fintech ecosystem in the country, widespread adoption of mobile wallets, and certainly a growth of last mile agent network and a high mobile penetration. We accelerated financial inclusion certainly in Colombia, but it also brought meaningful institutional capacity.

Its implementation required a high degree of coordination, it demanded collaboration with a private sector, partnership with telco companies, and testing new database and technology. This public and private innovation approach enable us to reach beneficiaries in a record time. This is one of the more than 400 emergency programs introduced during the pandemic and certainly that they all contribute to elevate economic downturn but they become a powerful tool for financial inclusion and showed meaningful learnings to allow us to jump into a next generation of digital G2P programs to boost financial wellbeing and economic development in the world. Thank you.

[David Malpass]

Very interesting, and we'll do some rounds. We have 40 minutes, so I'm really excited about the panel, and I'm going to come back to you, Ms. Prieto and ask in a few minutes, how much money went through that system, but let's turn to Ms. Sene. Coura Carine, in Sub-Saharan Africa, a third of adults use mobile money accounts. What changes do you see in how people use their mobile money products, and how were you able to take so big a market share in Senegal in a short period of time? Over to you.

[Coura Carine Sene]

Thank you, and I'm happy to be part of this prestigious panel. We all know that mobile money has been a key driver to digital financial inclusion in Africa particularly. Over the years, two things have changed, the type of providers, we now have fintechs like us, and the consumer use cases. During the first years only the use cases were restricting to cash in, cash out, person to person transfers, very few people were leaving balances in their wallets. Gradually, as access in mobile money sectors accrue, people started using wallets to also purchase air time and pay bills, which mean leaving money in the wallet. In the most recent years in Africa, we have seen mobile money beginning to reach its potential, being the raise on which we can offer, we can provide new financial services. In other words, the data and the information in the wallet can be used as a basis to offer loans, insurance, product, long-term savings, and we are witnessing this in multiple markets.

At Wave, we are noticing similar patterns in customer behavior. Peer-to-peer cash-in and cash-out are still dominating, but customers are using the Wave wallet to pay bills, utility, TV, toll free, and in Marketwave, we offer merchant payment. Customers are using Wave to do digital transaction at retail shop. It's worth noting that because we charge 0% for deposit and 0% for this server, people are also using Wave wallet as a saving instrument. Our low fees, combined with our customer user centric approach, are incentivizing our customers to use digital financial services. That's what we notice in Senegal, we have this high growth because we go from zero to more than 6 million users on a monthly basis because people can use Wave on a daily basis to do all their financial transaction, not only cash-in and cash-out and sending money to the bill of people, but also paying everywhere in the market, at the shops, and everything, and it's thanks to our customer user-centric approach and our technology.

[David Malpass]

Thank you. Quick question, do they have to have a smartphone or what phones can it work on?

[Coura Carine Sene]

For low-income and less educated people, they can use QR technology on a card and they can be assisted by an agent at our agent network. For others who have smartphone, they can enjoy our mobile application.

[David Malpass]

I'll come back to you. Ms. Mukherjee, I'm interested in the huge size of the access you're providing to underserved customers. You founded the platform in India to meet their financial goals. How does it work and how did it work through the pandemic?

[Sucharita Mukherjee]

Thank you so much for the opportunity to be a part of this distinguished panel. Kaleidofin is a fintech platform. We target 600 million customers, and we really believe in the power of complete financial services to make people's goals, their life goals a reality. During the pandemic, what happened for us was that there was certainly very rapid adoption of digital financial services, and we saw this particularly in cities. There was definitely an urban versus rural divide, and there was definitely also a gender divide over here. So a record, I think, 70 million-plus, 8% of Indian adults actually first started using digital payments during the pandemic, which is a big number and 12% is the total number, but it still tells you that India is a very large country, and even though we achieved a lot, there is still miles to go. In some sense, UPI as a platform has really helped achieve just that ubiquity of digital finance, making it available to every last mile.

One of the clear steps that we found very useful was to really combine technology with touch. It was mentioned earlier in the panel as well that having that assistance ready and available for customers is vital for enrollment. For example, we have a saving solution called Kaleido Goals, and in some sense we have to develop tech infrastructure that is both assisted as well as self-service. Otherwise, there are very large barriers preventing entry, and the savings solution really combines regular savings and emergency loan as well as insurance and therefore allows customers to connect with the end goal, which is sending her daughter to medical college, rather than grapple with the nitty-gritties of each of these financial products.

The intuitiveness of the design, the local language nature of both the apps, as well as the automated voice services, all of these are critical to build on top of the rails, which is bank accounts and payments to really build on that resilience, and that's really what we are aiming for because I think that we've gotten really far in terms of access. I think we want to go the next mile on building resilience through using better savings, credit, as well as insurance products.

[David Malpass]

Thank you. I'm sorry, I have a beginner question for you. Where does the savings reside? Does it reside in a mobile account or in a bank account? Who's the holder of the savings?

[Sucharita Mukherjee]

So, Kaleidofin as a platform is integrated both with banks, as well as with mutual funds, the least risky category of mutual funds, which actually invests in, for example, the equivalent of US Treasury bills. In some sense, we offer both savings and investments and we are integrated with about six mutual funds as well as two banks, so the savings resides [inaudible].

[David Malpass]

Thank you. Ms. Prieto... Both, thank you. Ms. Prieto, thanks again for joining. Colombia and you're the payment system, can you give us an indication of the size in any form that you want? I'm interested in the number of transactions per month or per year and the volume of money that goes through the system, and has that been growing and does it have potential for scalability?

[Ana Maria Prieto]

It has been growing as far as we have been able to reach more and more households. We are now 26 months of the run of the whole program, since we introduced it for the first time. We almost reached the entire set of the 3 million households that was initially thought of or designed for. This is 3 billion US dollars that we have channeled through this system, and this is a monthly payment installment. We have permanently the program running through the financial system, through the payment system, and as I mentioned earlier, people keep using their wallets, not just for receiving the aid, but to initiate payments, to make P2P transfers for family members and start to have this built network effect around this financial instrument.

[David Malpass]

Thank you. Ms. Sene, can you give us size metrics, both for Senegal, but then what are the key steps that allowed the market to form there? Are you looking at any other markets in West Africa? Would your system work elsewhere? We heard the reference from India for the UPI, the universal personal identifier, and so is that an important issue for you within Senegal or in West Africa? Also, could you tell us about your dollar volumes? Can it expand?

[Coura Carine Sene]

So beyond Senegal, we are operating in other African countries like Cote d'Ivoire, Mali, Burkina Faso, and out of West Africa, we are also in Uganda. We want to expand in many countries in Africa. We know that in Asia, in India, things are evolving and we believe that we have high needs in Africa, and that's why we want to focus there for now. What are the steps we are taking to ensure that we are growing and we are tackling people's needs? As I said previously, we are building a customer centric product where we are giving people opportunities to transact thanks to our card because we have many low income and less educated people in our countries. They can appreciate the Wave experience at agent. We are also answering great customer experience. We are the few mobile money companies in Africa that created an agent application. This allows agents to be able to read clearcard, to do KYC collections that is important for the central bank, and many other options. Additionally, we have an engineering team that has built an in-house system to be able to continuously monitor the liquidity in the territory to allow good experience because the challenge is to make digital finance better than using cash. We also build rapid customer reduction mechanism that is allowing people to reverse a transaction when they make a mistake because our customers are low educated, and that has been a game changer in Africa, where we are.

By millions of low income and illiterate customers with Wave because they know that we have that when they do a mistake. We also have mystery shopper in all the territory to report us feedback as a normal customer and to find issues we should fix for customer protection and branding or agent. Senegal was a success, now very big. We are addressing 55% of adults in Senegal. We are billions of transactions a day. We are now addressing the merchant pay, pay everywhere in pharmacies, not only on informal shops, and we are growing also in Cote D'Ivoire very quickly. We are following the same trajectory, and I don't know if I answered all your questions. You have many questions.

[David Malpass]

I did. We have a delay in our digital, so I'm going to keep doing long questions for you, so I apologize in advance. Sucharita, so here's the long question, innovation is really important in all of this, and I want to ask you, what barriers do you see occurring in India, and if there's any single thing that you think would allow you to move forward faster? You mentioned the rural urban divide, so is there something going on that's allowing access in rural areas and usage in rural areas of India? You mentioned that the language is a big... That you operate apps in multiple dialects or languages, and so what other kinds of things will enable you to grow and reach rural areas and reach women?

[Sucharita Mukherjee]

Absolutely. It's a great question. I think every challenge has a solution, and if I were to think about the three biggest challenges, and I'll talk about the solutions to each of them, one is as Mr. Gates pointed out, cash-in, cash-out points. If you think about it, when did we go digital? When did you go digital? It was when we were very confident that we could turn and go to a cash point and take out money from our bank account at any point of time if we wanted. So, we believe that more, all pervasive cash in and cash out infrastructure is required in rural India to push up digitization because that is going to build trust. What we are doing here is actually partnering with payment banks, as well as very large banking correspondent networks to deepen that network.

Having said that, I do believe that policy also has a role to play here, to accelerate the cash-in, cash-out infrastructure. The second is just the movement from access to resilience, and I think there are two, three things we can do. We saw the gender gap reducing to zero in India, which is fantastic from an account ownership perspective and also account ownership itself doubled to 75% plus. However, the levels of inactivity remain high, and we have to ask ourselves the question why, why the inactivity is so high because we come across this every day, even before the Findex survey came out because we know this, we are meeting the customers every day.

One, I think is we need to innovate and provide customers better bank accounts with fairer charges, more transparent charges, more transparent grievance redressing mechanisms because if there are, let's say 100 categories of charges and the customer does not know what charge they might be hit with, that is obviously going to be a barrier to active usage because you're anxious right about these charges that might hit you and then cash feels safe and you might stick to cash.

Again, here we have innovated with a few banks, still a drop in the ocean, on really innovating products that allow flexible payments, no minimum balances, no bounce charges, and so on, so that this doesn't remain a barrier anymore. So, that's the second one, and the third one really is local language. You said it, but India is a very diverse country. It's essentially a continent, and in some sense we really have to develop voice for all our local languages, the voice based tech much further. Just to give you an example, Kaleidofin actually has both apps, customer service and launches local languages, but also dialects because each language is spoken in so many different ways.

We find that when customers have the ability to speak with us, either through an automated bot or through a real person, if they're well understood, that's again, very basic. I'm going to add a fourth one actually, very quickly, which is we do believe that, especially from a gender perspective, smartphones and digitization will take a little bit of time for women, and we do need to find ways for women with access to largely feature phones to find the right financial products. For example, Kaleido Pay, one of our digital payment products, actually works even for feature phone customers. It works even for regional rural banks, any kind of cooperative bank, and it can also set up recurring payment mandates. Again, very much the start of a long journey, but I think assistance and building [inaudible] and thinking that trust is not going to come in a day and therefore from local [inaudible].

[David Malpass]

You're breaking up a bit, so I'm going to go to Ms. Prieto, but let me comment on that. We heard two different models, I think. One commonality between Ms. Sene is the language importance and the importance of connecting with the customer, but the difference that I was picking up, and I want to ask Ms. Prieto about it is the role of a bank in it. I was hearing things that connected with me on my experience. I remember very distinctly when ATM machines, automatic cash out machines appeared in the US and it was a giant relief because you didn't have to go into the bank, but then you also always had this concern about what were the fees going to be, and that still even continues now, whereas Ms. Sene was talking about a system where you could bypass that and have much of the transactions being done without cash being involved. So, I want to ask Ms. Prieto in Colombia, are banks still in the middle of the transactions and do people worry about the fees and how do you address that? Any comments?

[Ana Maria Prieto]

Yeah, we are kind of in the middle of the transition. Obviously, the ecosystem has seen a lot of disruption, transformation, and the arrival of new players, fintech players, and a lot of new providers, especially in the digital payment arena. That's where I believe has been the strong disruption taking place. But yes, we do need to... Governments have a responsibility in enabling a regulatory framework, making sure that we have full disclosure of fees, costs, and general requirements of how people can actually access the financial instruments or payments and what is exactly going to be the cost and the frictions around using those instruments. I believe digital payments play a really key role in fostering financial inclusion and governments really need to take over making sure that we have those pipes and that basic transactional learning infrastructure so that people can navigate those waters without going back to cash. In Latin America, all of the governments and central banks have been taking this too seriously in deploying fast payment rails.

We have Pix in Brazil, which is stunning figures and example of how fast and disruptive can fast rails come in, even with non-bank players, non-bank acquirers, for example, that's also the case in Colombia. We recently opened our legal or regulatory framework for those new players, but yes, to your point and to your question, David, about cost and fees, we still need to play hard from the regulatory side to make sure that there's full disclosure, and then we can move into an even lower cost distribution and usage of financial services and payment instruments.

[David Malpass]

Do you envision a future where cash will be... In the US and Europe, there's been a big transformation away from cash. The amount of cash used in transactions is going way down but we may end with Ms. Mukherjee, who's back with us, but in India they're still using cash because it's a confidence building step. In Colombia, where is that? Do people want to see the actual cash come out of their account or are they beyond that point and ready to be all digital?

[Ana Maria Prieto]

We are not yet at that point. I think we still see cash safe as you were mentioning earlier, and especially for the low income people at the base of the pyramid. That's where the inefficiency of cash remains at the end. We are in kind of in the journey to progress into that cashless society. We do as central banks and government have an aspirational objective in fostering and taking over this financial inclusion advance that we are seeing to make sure that we can accelerate that path to a more cashless society, especially to benefit those low income people that really suffer and feel the harm of still using cash and the informality cycle that comes around it.

[David Malpass]

Coura Carine, how do you see this? Is there a chance in Africa that people leapfrog the step that's going on in India... I don't know if I'm summarizing it right, but of building confidence in basically in bank accounts and enabling more and more activities. Do you see West Africa leapfrogging to the point where it's mobile money and all of the transactions go through that and you're cashless from an earlier stage? How do you see that?

[Coura Carine Sene]

I can say that it's happening. It's happening because let me come back to the numbers today. In Senegal, we have around 43 million transactions per day at Wave. That represents 66% of the GDP in terms of volume for Senegal. So, Wave was established to address the inequality in access to financial services. According to the 2017 Findex Report, 57% of adults in the African continent are unbanked. We have to address the key point that customers are facing. Primarily digital financial services on the African continent are expensive, and the user experience is suboptimal. Costly financial services means that low-income individuals, especially women and young people will continue to remain excluded or underserved. Suboptimal user experience means that customers will continue to use cash and only use digital financial services when it's absolutely necessary. At Wave, we want to change the status quo in Africa.

We want to transform how customers engage with digital financial services. That's why we begin with zero-zero-one pricing: 0% cost of cash depositing, 0% on withdrawal, and 1% of transfers. Our vision is to be a long life partner to our customer, and I want also to reinforce what we said about local languages. In our agent application and customer application, we are communicating with our users in the local languages and all our customer services is also able to communicate in local languages with people when they're calling to complain. We want to help them to save, to pay, to borrow, to invest, and we are building the infrastructure, the technology, and the partnership to allow for this. The government, regulator, private sector are part of this mission to lower barriers and to help us to expand access and use of financial services among unbanked. Our vision is not only to deepening financial inclusion, but also we want to accelerate African economies on a path to becoming cashless.

[David Malpass]

That's a really a great vision, and the Findex Report is showing us data on the progress in various areas of this, and I'm really struck as all of you are talking about the importance of only with digitalization can you really have all of the language... You have apps that work in languages and really connect with people that are in very different walks of life, whether rural and urban, or in different ecospheres within their region. That gives the potential that we see in digitalization. Let's close with Ms. Mukherjee. She is the Co-founder and CEO of Kaleidofin. You were offline for a moment, so I don't know if you heard my summarization and I'd welcome if you adjust it. I was saying India seems to be on a little different path because of the role that you described of cash in, cash out and people wanting to build confidence by actually seeing currency, actual cash. Whereas some parts of the world are jumping more toward cashless. Could you reflect on that and anything else that you would like to comment on from India? We all aspire to having a 600 million customer market and success story. Give us reflections on how this will work in India, and is it a different course that's going on? Oh, and I'm sorry, I get to do a long question, we heard from Ms. Sene, the zero-zero-one process, very low fees in Senegal in order to attract and build market share. Is there anything like that going on in India? Over to you for the closing, thanks.

[Sucharita Mukherjee]

Thank you so much and apologies for the technical difficulty. I do think there are many common themes that are emerging from Colombia, from Senegal, and from India. There is very much one segment of India that is leapfrogging, which is very much urban India, including let's say a vegetable vendor, a grocery store owner in urban India who is completely leapfrogging. We don't need a card at all, you just need your mobile, and we are now up to 6 billion in UPI transactions in a month. It's pretty staggering, just the volumes but I think we also have to note that all of these 6 billion transactions come from 12% of Indians, and therefore there is very much a different story in rural India. In rural India... I don't think people need to see cash as much.

The thing is that the economy works in cash. You receive your incomes in cash, and therefore you do need a way to transform that physical cash that you have received from your employer into digital. There is a real customer need here. It's not just about confidence. I think confidence is one of the factors, for sure, but I think there is a real need to convert physical cash to digital money.

In some sense the cash in, cash out infrastructure does both. It gives you that way, and clearly there are significant amount of initiatives. For example, there are over a million plus banking correspondent, roving points, which are like micro ATMs that can deliver cash in a mobile way through biometric authentication anywhere, anytime. We just need more of this. Since India is a very large country and we need this within half a kilometer, we need this within one kilometer.

From a gender perspective, I'd also like to say that mobility is not something we can take for granted. Let's say two to three kilometers might be okay in other countries, perhaps where there is mobile mobility for women, but not in India. In India, we need this cash point to be within half a kilometer, within walking distance. Otherwise, you'll get asked questions, where are you going? We do need to keep that as well in mind.

Then, I think the third thing that's happening in India very rapidly is just the innovation in financial products and the innovation and financial advice and really dropping that cost down to a fraction of what it even costs a wealthy person is happening super rapidly.

Very similar to in Senegal, I think zero cost bank accounts with zero bounce charges, zero minimum balance are being launched. Again, they need to become ubiquitous, so we need more scale. So just to give you an example, our customers and we've seen about $1 billion of finance go through Kaleidofin platform today, our customers, about 70% of them, now feel that they're able to handle an external shock. Now, this is clearly not representation of India, but we need to scale up. We need more of us as well, and in many parts of the world I would suspect.

[David Malpass]

That's a very good close. The resilience is important, and I'm struck also by the commonality of digital. All of you are working on zeros and ones, kind of a binary system that is massively powerful, but then is applied in very different ways in different parts of the world. Findex is picking up the complexity of the data and the progress being made and it's a mainstream part of the World Bank to try to support the digitalization, recognizing the many benefits that you all have shared with us. We give very warm thanks to the panel, that was fascinating. Thanks, everyone. Bye now.

[Rachelle Akuffo]

A big thank you to all of our panelists for the great discussion today. Now, we're coming to the end of our event, but we want to get a few closing thoughts from Her Majesty Queen Maxima of the Netherlands, who's also the UN Secretary General's Special Advocate for Inclusive Finance for Development.

[Queen Maxima]

Ladies and gentlemen, I am thrilled to join you for the launch of the very much anticipated new Global Findex Report. Today's report gives us a fresh opportunity to take stock of what has been achieved and the work still ahead of us. For many years, I have championed financial technology as a pathway to greater prosperity and financial health. We now have more evidence that it's working. The updated Findex shows that a technological revolution across the globe has fueled a sharp rise in the use of financial technology. From India to Kenya, even the smallest merchants in rural markets are being paid and making payments with the mobile phones that they carry in their pockets. We have also learned that millions of more women have a financial account. When the Findex 2017 Report came out, there was a 9% difference in the numbers of men and women accessing and using financial accounts.

But, this stubborn agenda gap has finally begun to close. In the last five years, the gap narrowed from nine to six percentage points in developing countries and from seven to four percentage points globally. And although women are still less likely than men to use digital payments, the good news is that when they do have an account, they're just as likely as men to use it. Today's report is being released at a time of great change and uncertainty. Every year, people around the world face unexpected financial challenges, a job loss, illness, crop failure or natural disaster can quickly derail hopes and aspirations for a better life. The report's new insights on financial worrying gives us a more complete picture of people's financial health. It also shines a light on how people are becoming more resilient to these kinds of shocks. In terms of financial stress, people often turn to family and friends for help, but when everyone is under the same stress, such as during a pandemic or a drought, these social networks can be unreliable.

Financial inclusion offers more resilience. Research shows that where a woman gets an account, she builds savings, spends more on her children's education and invests in business opportunities. The Findex data charts all this progress and more, but it also shows that we have reached a turning point. Most people who can easily open a bank account have already done so. The next step is to ensure that they can access other products and services like savings, credits and insurance that really truly meet their needs and improve their financial health. But there is a steeper hill to climb. Almost 30% of adults in developing countries are still unbanked and much harder to reach. Countries should make the right investments to reach those who remain left out. From more inclusive financial policies to connecting rural customers to the internet, government and the private sector can step up to meet this demand.

Digital technologies are changing people's financial lives. Worldwide, people are using mobile phones and apps to pay bills, save money, and run their businesses. This makes it vital to protect financial consumers and help them build their digital and financial literacy skills. Congratulations on this new edition on this milestone report. The data it provides will guide our efforts and help make the dream of universal access to finance our reality. I also look forward to the future indicators and financial resilience that will provide us with insights on individuals' financial health. These will allow us to follow the effects on financial access on people's lives. They will also help us to identify other services that people need to achieve their goals. Thank you.

[Rachelle Akuffo]

On that inspiring note, we wrap up today's great event. You can catch the replay at World Bank Live starting later today, and don't forget to comment using the hashtag #GlobalFindex. To learn more about the Global Findex Report, go to globalfindex.worldbank.org. A big thank you to all of our viewers who've joined us from around the world. We really hope you've enjoyed today's event. Goodbye for now.